by Kenneth Cerullo, Esq.

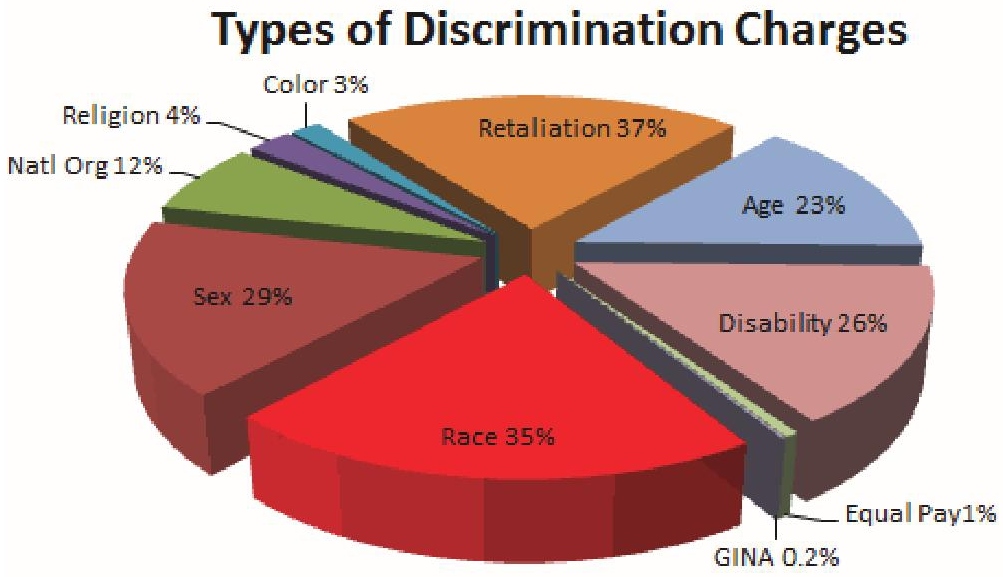

Did you realize that employment related lawsuits comprise a very large portion of the court dockets in Bergen and Passaic Counties?

With that information in mind, is your company covered if someone you interviewed alleges he did not get hired due to his race or ethnic background? How about if a female office assistant sues you alleging you created a hostile work environment by failing to reprimand your star salesman for “hitting on” her and joking about her physical attributes? Or how about that employee you terminated because he filed a workers’ compensation claim or the other employee you fired on the spot for stealing. Yes, he stole from you and you get sued! Believe it or not – this happens!! And you don’t want to find out after the lawsuit is filed that you are without coverage!

Even innocent and unintentional conduct that on its face appears to be consensual can turn into a serious claim. During this summer’s politically charged environment, we can all envision a foreman joking around with workers of Mexican descent that Trump is going to “build a wall” to keep them out. Business owners should be wary of such conduct – and take the risk seriously!

The name of the insurance policy providing such coverage is referred to in the insurance industry as Employment Practices Liability Insurance (EPLI). Employment practices coverage is usually excluded from your general liability policy

Whether you are hiring, firing or just managing your employees on a day to day basis, you have a risk of a claim that could put you out of business. Besides the more common types of claims under EPLI policies including wrongful termination, discrimination or sexual harassment, many policies cover claims arising out of other inappropriate workplace conduct including (but not limited to) defamation, invasion of privacy, failure to promote, deprivation of career opportunity, and negligent evaluation. Third-party employment practice coverage is also available to cover liability claims by non-employees such as customers and vendors.

Many owners are surprised to find out that the claim can still cost hundreds of thousands of dollars even if they have no fault and are ultimately found not liable. Why? Because the attorney fees can be very costly to defend such a lawsuit. Such litigation includes a great deal of discovery to unravel the merits of the claim. It’s classic he said, she said!

What makes the claims more costly is that companies rarely do what is necessary to limit and help protect themselves from such claims. Some of the risk management techniques available to businesses include employee handbooks with policies and procedures reviewed by your attorney, along with training of supervisors and employees regarding impermissible conduct (including but not limited to discrimination and sexual harassment) and ways for potential victims to make a complaint should the need arise.

The premium charged for EPLI coverage depends a several factors including the type of business being insured, the number of employees, prior lawsuits or claims, percentage of employee turnover, and whether the insured has implemented established rules and practices as discussed above.

EPLI can be provided as a separate policy or sometimes by endorsement to the general liability policy. EPLI is usually written on a claims-made basis, meaning the incident resulting in a claim must occur during the coverage period (so an employer may be exposed if coverage is dropped and a claim comes in months or years after the alleged incident).

Many companies writing EPLI coverage will offer a support helpline, standard policies, forms and checklists for your assistance. It makes sense because it is in their interest to help reduce the risk of a claim!

I have seen numerous employment related claims and the business owner always regrets not getting the coverage. But even if you do not obtain the coverage, you should have that conversation with your insurance agent and know your risks!

Kenneth F. Cerullo, Esq. is the President and an Owner of The Commercial Agency, Inc. in Park Ridge, NJ along with his brother Steve. He is also a Co-Founder of the New Jersey Agents Alliance (NJAA) – a limited group of select agents spread throughout the State of NJ with over $175 Million is premium volume. Ken currently serves as the Legislative Chairperson for the NJLCA and can be reached by email at [email protected] or (201) 391-1324. You can also visit the Agency websites at www.thecommercialagency.com or www.bergensnowplowinsurance.com

The information set forth in this article is general in nature and no legal advice is being given. Insureds are recommended to speak with their own insurance agent and attorney to discuss their own particular risk exposures and needs.

Weather Works

Fall and Winter 2016 Outlook

FALL: The fall season comes in connected to the tropics for a very wet month at times, for October standards. We may even see a tropical system up the coast. La Nina starts to peak in November and December and that will shut off the tropical moisture as we head into winter. November is right on track with temperatures and rainfall, but we’ll drop to a colder trend toward Thanksgiving with a major influence of La Nina by the start of December. Be on guard for an early season light snow right after Thanksgiving or the first few days of December.

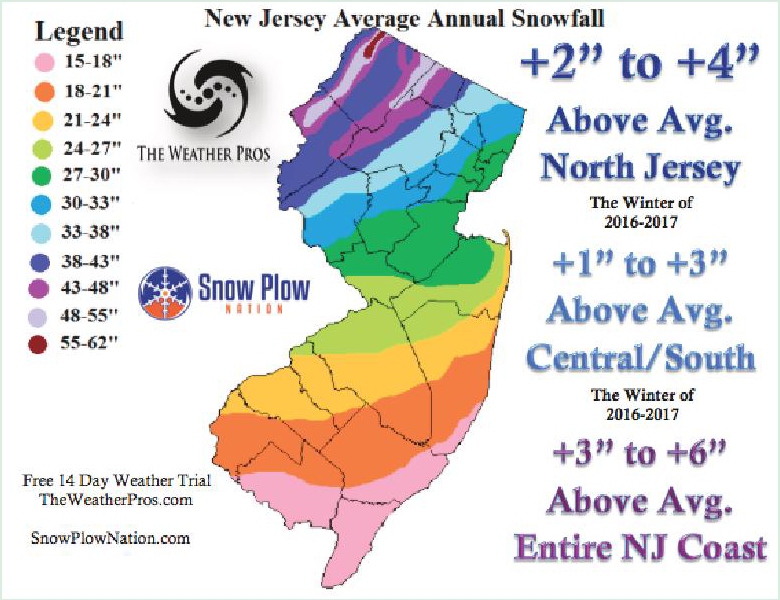

LA NINA IS HERE: All signs point to a weak La Nina this winter. That’s good news if you charge by the inch and also by season. Why would this benefit you? We see an average snowfall this winter to about 10% above average, so if you charge by the inch and by the treatment you’ll see a decent winter with plenty of chances to use that leftover salt from last winter. The seasonal accounts will average about 5% to 10% extra of what you bid, due to a few extra treatments and inches of snow, but you won’t be overworking all that much vs. an average winter.

WINTER: Unlike last winter, El Nino is gone and so is the chance of a mild start. We see early season snow in late November or early December and it will stay colder than normal all winter. The snowiest month will be January with two nor’easters of 4”+ this winter. This is based on the 17 La Nina winters in NJ the past 66 years. Overall, the state will see 0% to 10% above average snowfall with 15% to 20% above average along the entire Jersey shore. Expect many smaller snow systems this winter, with a low risk of an ice storm.

Rob Guarino is President of The Weather Pros, a weather consulting firm, and 3 other weather related websites. He was chief Meteorologist at Fox in Philadelphia for over 10 years serving NJ and PA. He has won 12 regional and national awards for accuracy and forecasting and is a member of the NJLCA.